Driven by the global wave of carbon neutrality and China’s “Manufacturing Powerhouse” strategy, IGBT (Insulated Gate Bipolar Transistor) has emerged as the “heart” of electrical power conversion and control. It has become a core foundation for strategic emerging industries such as new energy vehicles, photovoltaic power generation, industrial control, and smart home appliances. By 2025, China’s IGBT market size will exceed RMB 80 billion, with a projected compound annual growth rate (CAGR) surpassing 20% over the next five years. Domestic production rates have surged from under 10% in 2020 to 45%, yet the high-end market remains dominated by international giants like Infineon and Mitsubishi. This technological catch-up and supply chain security race is reshaping the global power semiconductor industry landscape.

I. Market Explosion: Dual-Engine Growth from Demand and Policy Incentives

1. New Energy Vehicles: The Rise of the Largest Single Application Market

Electric drive systems, on-board chargers (OBC), and DC-DC converters in new energy vehicles account for over 60% of IGBT demand. Take the BYD Han EV as an example: its main drive inverter uses self-developed IGBT modules, with each vehicle requiring 150-200 units—a tenfold increase over traditional fuel vehicles. By 2025, China’s NEV penetration rate will exceed 45%, driving the automotive-grade IGBT market to reach 32 billion yuan, accounting for 40% of the overall market.

2. Photovoltaics and Energy Storage: Growth Engines for Dual Carbon Goals

Surge in demand for PV inverters and power conversion systems (PCS) is driving a 28% CAGR in the high-voltage IGBT (1700V-6500V) market. Huawei Digital Energy’s smart PV solutions require over 500,000 IGBT modules per GW of installed capacity. With global PV installations projected to reach 450GW by 2025, this translates to over 2.25 billion IGBT units needed.

3. Industrial Control & Home Appliances: Main Battlefield for Domestic Substitution

In industrial sectors like inverters and servo drives, domestic firms such as Sida Semiconductor and Silan Microelectronics have achieved 75% domestic substitution. For home appliances including inverter air conditioners and refrigerators, the domestic production rate of IPM (Integrated Power Modules) reaches 90%. Midea Group’s procurement of domestic IGBTs will rise from 12% in 2020 to 58% by 2025.

II. Technological Iteration: Dual Challenges of SiC Integration and Process Breakthroughs

1. Third-Generation Semiconductor Impact: The Competitive-Collaborative Relationship Between SiC and IGBT

Tesla’s Model 3 Plaid edition pioneered the use of SiC MOSFETs to replace some IGBTs, boosting inverter efficiency by 5% and reducing volume by 30%. However, SiC costs 3-5 times more than silicon-based IGBTs, and the 800V high-voltage platform remains unpopular. CRRC Times Electric forecasts that SiC will capture 30% of the high-end EV main drive market share between 2025 and 2030, while optimized silicon-based IGBTs will remain dominant in medium-to-low voltage applications (e.g., OBC, DC-DC).

2. Chip Design: The Technological Leap from Planar Gate to Micro-Trench

Infineon’s seventh-generation Trench Field Stop technology reduces on-resistance from 1.7V to 1.3V, cutting switching losses by 30%. Domestic firms are accelerating their pursuit: STMicroelectronics’ sixth-generation FP-IQ series, scheduled for mass production in 2025, achieves a conduction voltage drop of 1.5V and has passed AEC-Q101 automotive certification. However, its endurance testing (100,000 switching cycles) still lags 20% behind international standards.

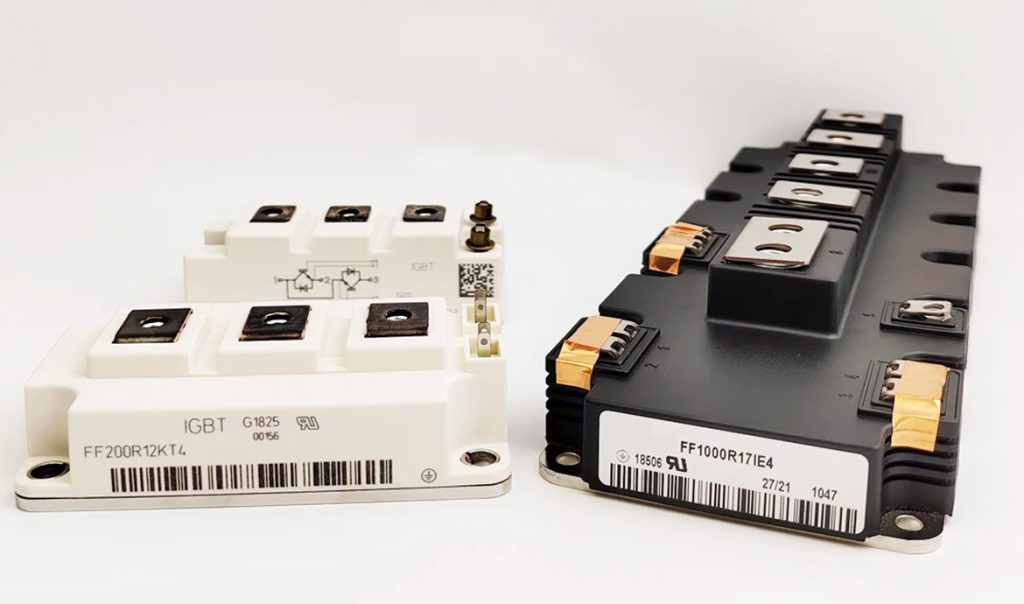

3. Packaging Processes: Breakthroughs in Sintering and Dual-Side Cooling

Silane Micro’s sintered silver packaging technology reduces module thermal resistance from 0.15℃/W to 0.08℃/W, boosting power density by 40%. Huawei Digital Energy’s dual-side cooled IGBT modules enhance heat dissipation efficiency by 60% over traditional single-side cooling and are deployed in its 1500V photovoltaic inverters.

III. Supply Chain Security: Breakthroughs in Wafer Manufacturing and Vertical Integration

1. Upstream Bottlenecks: Domestic Production of 12-inch Wafers and FS Processes

High-voltage IGBTs rely on 12-inch wafers, yet domestic manufacturers like Huahong Semiconductor and Jita Semiconductor account for only 8% of global FS-IGBT process capacity. This leaves China with a 65% import dependency for high-end wafers by 2025. BYD Semiconductor’s RMB 10 billion investment in an 8-inch IGBT-dedicated production line will reach 480,000 wafers/year by 2025, though its 12-inch line remains in planning.

2. Vertical Integration Models: The IDM vs. Virtual IDM Game

Infineon controls 40% of the global IGBT market share through its IDM model. Domestic firms explore the “design + foundry” virtual IDM model: STMicroelectronics and Hua Hong Semiconductor have formed a deep partnership, boosting the yield rate of automotive-grade IGBT modules from 85% to 92% by 2025, with costs 18% lower than imported products.

3. Geopolitical Impact: Accelerating Supply Chain Restructuring

The U.S. tightened semiconductor equipment export controls on China in 2025, delaying expansion of domestic 12-inch wafer fabs by 6-12 months. CRRC Times Electric adopted a “domestic foundry + overseas backup” strategy, establishing an IGBT module packaging line in Malaysia to safeguard global supply chain stability.

IV. Competitive Landscape: Breakthrough Pathways for Domestic Players

1. Leading Players: Technology-Driven Innovation and Ecosystem Development

Leveraging its dominance in the new energy vehicle sector, BYD Semiconductor is projected to ship 12 million automotive-grade IGBTs by 2025, increasing its global market share to 12%. Sida Semiconductor acquired Swiss Excelex to secure sixth-generation IGBT technology patents, boosting its high-end market revenue share from 15% in 2020 to 35%.

2. SMEs: Differentiated Competition in Niche Markets

Xinji Energy focuses on photovoltaics, developing 1700V IGBT modules with 98.7% efficiency that have entered Sungrow’s supply chain. Xinneng Technology specializes in home appliance IPM modules, offering 25% lower costs than international brands and targeting an 18% market share by 2025.

3. Investment Risks: Technology Pathway and Overcapacity Warnings

By 2025, China will have over 120 IGBT manufacturers, with only 65% capacity utilization in the low-to-medium voltage segment. Price wars have driven gross margins down from 35% in 2020 to 22%. Investors should prioritize companies with automotive-grade certification, SiC technology roadmaps, and vertical integration capabilities.

V. Future Trends: Industry Landscape Outlook for 2030

1. Technology Convergence: Parallel Adoption of SiC IGBT Hybrid Modules and Full-SiC Solutions

By 2030, high-end EV main drives will adopt “SiC MOSFET + IGBT” hybrid topologies, reducing costs by 40% compared to full-SiC solutions. SiC penetration in medium-low voltage applications (e.g., OBC) will reach 50%.

2. Market Differentiation: High-End Breakthroughs and Mid-to-Low-End Consolidation

Automotive-grade IGBT gross margins will stabilize at 45%-50%, while home appliance segments may see margins drop to 15% due to price wars. China’s top five manufacturers are projected to capture 70% market share by 2030, further consolidating industry concentration.

3. Global Expansion: Overseas Opportunities for Chinese Firms

Southeast Asia’s new energy vehicle market grows at a 35% CAGR. Manufacturers like BYD and Great Wall Motors establishing plants in Thailand and Indonesia will drive a fivefold increase in Chinese IGBT module exports from 2025 to 2030.

Conclusion: The 2025 Chinese IGBT market represents both a critical battle for technological catch-up and a defensive war for supply chain security. Domestic enterprises must achieve continuous breakthroughs in automotive-grade certification, wafer manufacturing, and third-generation semiconductor technologies to secure a competitive position in the global power semiconductor arena. For investors, focusing on companies with high technological barriers and comprehensive ecosystem layouts will be key to navigating industry cycles.